5 Potential September 2025 Stocks: Analysis from a Trader's Practical Perspective

Recommendations Worth Considering but Requiring Caution

From the perspective of a trader who has experienced multiple market cycles, I see this list of 5 recommended stocks has bright spots but also needs objective evaluation. Looking back at my journey from losing $1000 in forex, I learned not to trust recommendations completely but to have independent analysis.

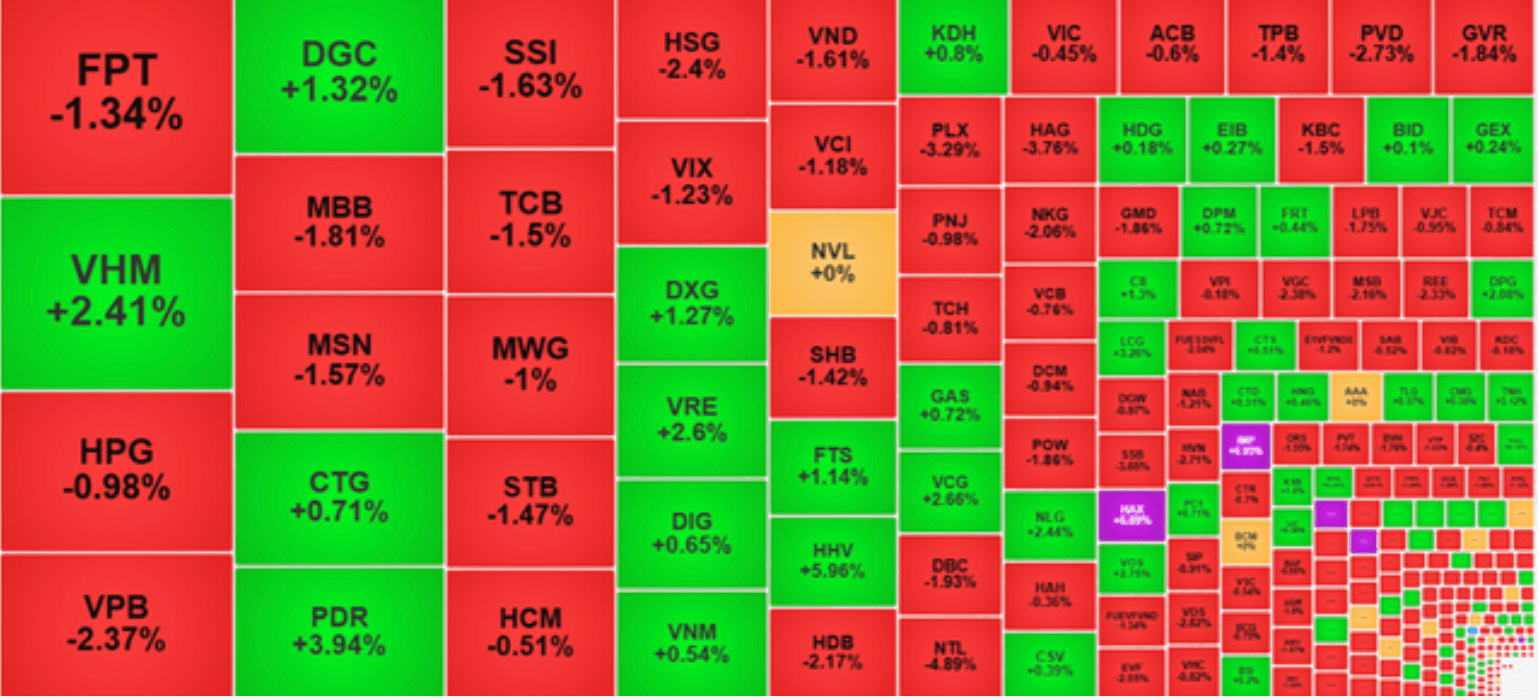

Analysis of Individual Mentioned Stocks

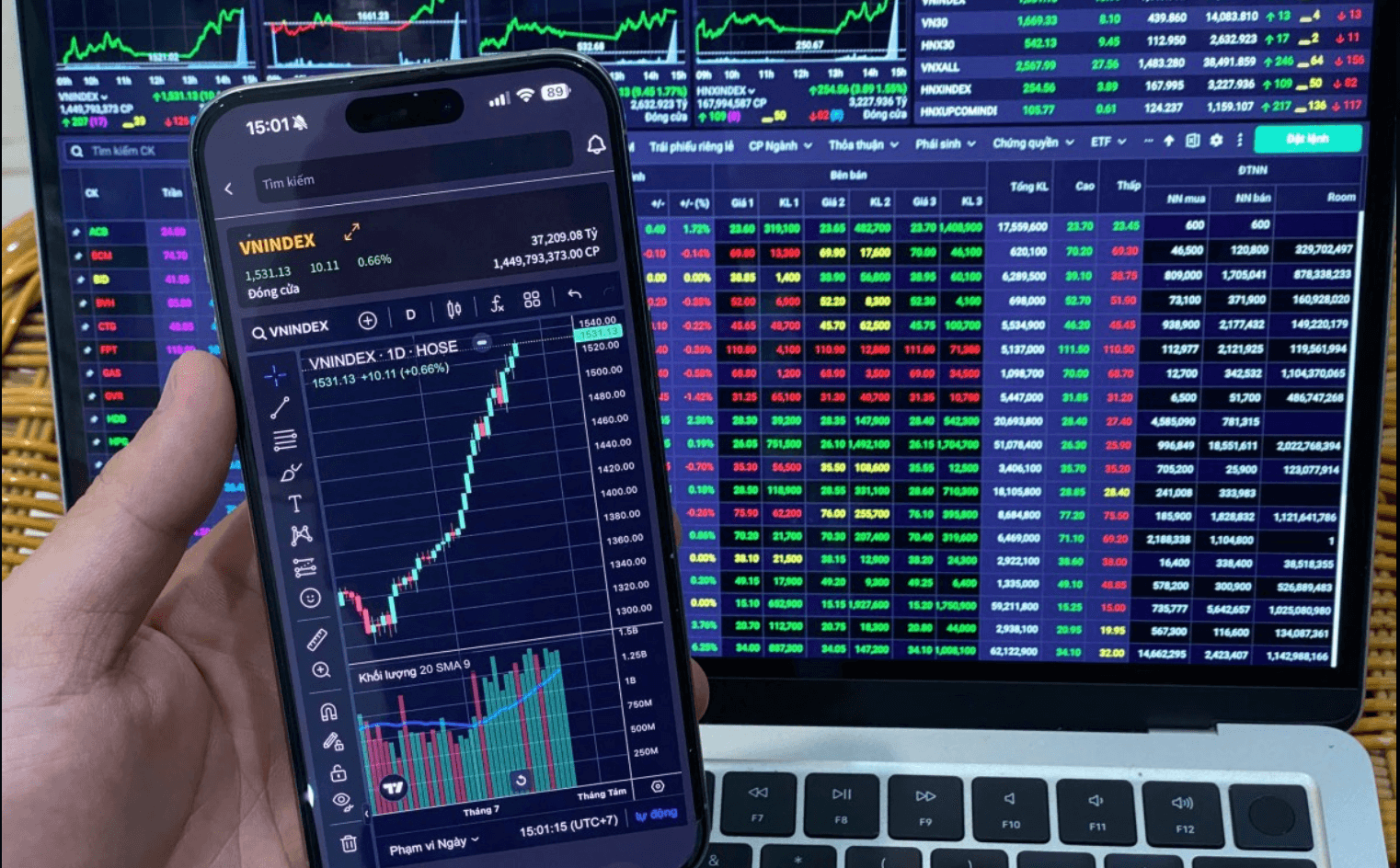

Vinamilk (VNM) with expectations of 31% growth in 12 months seems optimistic. Al Brooks once taught me that when a prediction is too specific and positive, we need to question the methodology behind it. The dairy industry faces intense competition and changing consumption habits, especially from younger generations.

FPT (FPT) is truly a good growth story in the technology sector. However, current valuation already reflects most of the growth story. Bob Volman once emphasized the importance of entry points - buying good stocks at high prices can still yield disappointing results.

Viettel Construction (CTR) benefiting from infrastructure investment is logical. But note that construction companies often have unstable cash flows and depend heavily on government policies.

Risks in Overly Optimistic Recommendations

Luna, my ragdoll cat, always carefully observes before jumping - this is an attitude investors need to learn. In TramNgo FX-Crypto Community, I often remind about risks of blindly following recommendations:

Target prices of 20-31% in 12 months sound attractive but markets don't always move according to predictions. Market sentiment can change rapidly due to unpredictable factors.

Sector Allocation Analysis

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required