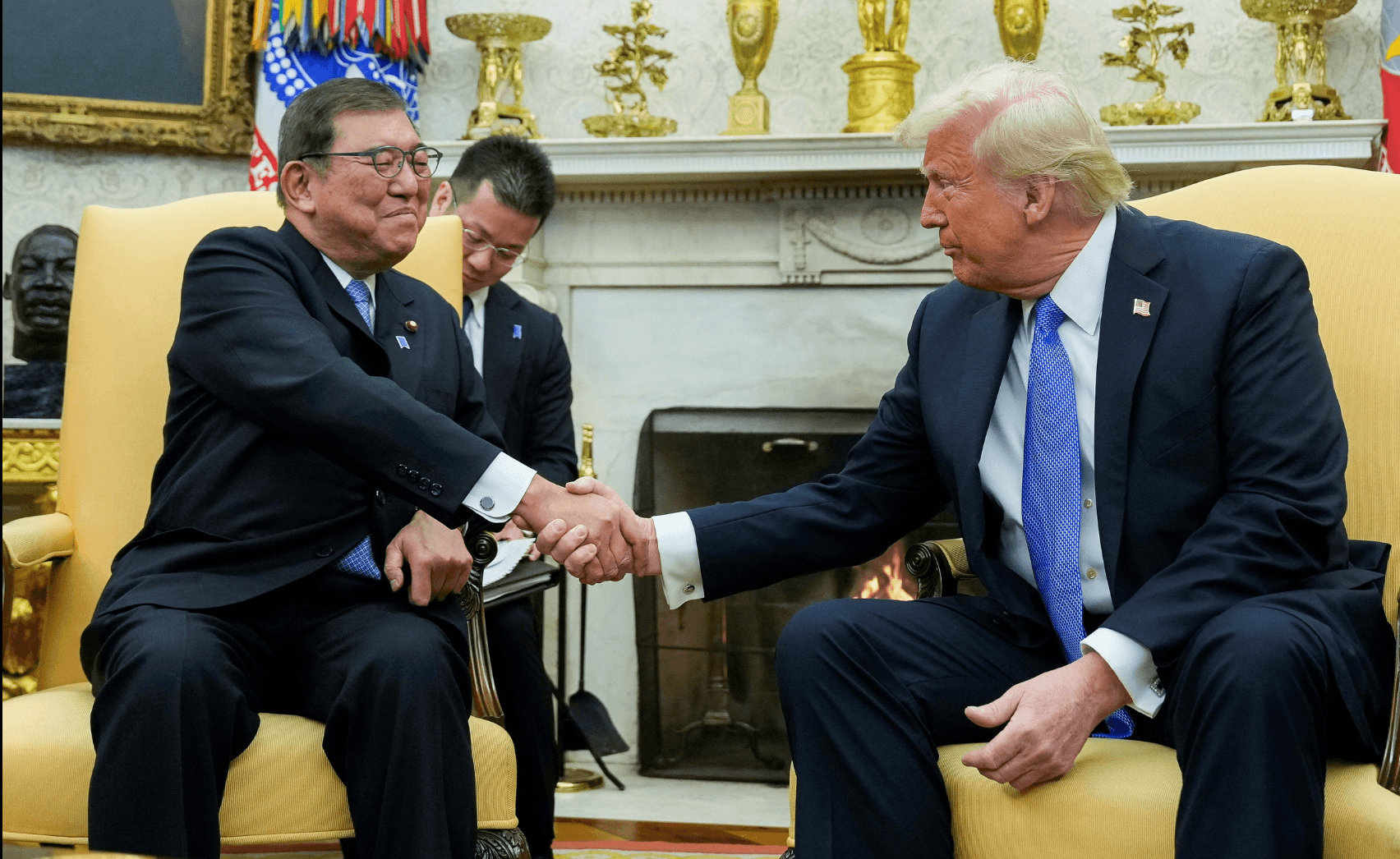

Japan and South Korea Commit Massive $900 Billion Investment to the US: What Signal for Global Markets?

Looking Back from a Trader's Experience

From the perspective of a trader who has weathered many market storms, I see this move as more than just diplomatic maneuvering. When Japan and South Korea commit to investing up to $900 billion in the US - with Japan shouldering more than half of this capital - we're witnessing a major strategic chess move on the global financial board.

I remember my early days losing $1000 in forex, when I didn't yet understand the bigger game behind the scenes. Now, after years of studying G10 currency manipulation and how central banks intervene in markets, I can clearly see the real motivation behind this $900 billion figure.

Macro-Level Price Action Analysis

Looking through the price action analysis lens I learned from Al Brooks, this is a classic breakout pattern at the macro level. When two major economies simultaneously "go all-in" on one market, it's not coincidence but a calculated move to maintain their position in the international financial system.

This is how Japan and South Korea hedge political risk amid global trade tensions. Rather than waiting for unexpected tariff strikes or sanctions, these two countries chose to "buy insurance" through massive investment commitments.

Just one step to unlock the rest of this article

Sign in to read the full article and access exclusive content

✨ Completely free • No credit card required